Major Shift: Federal Judge Puts Medical Debt Back on Credit Reports

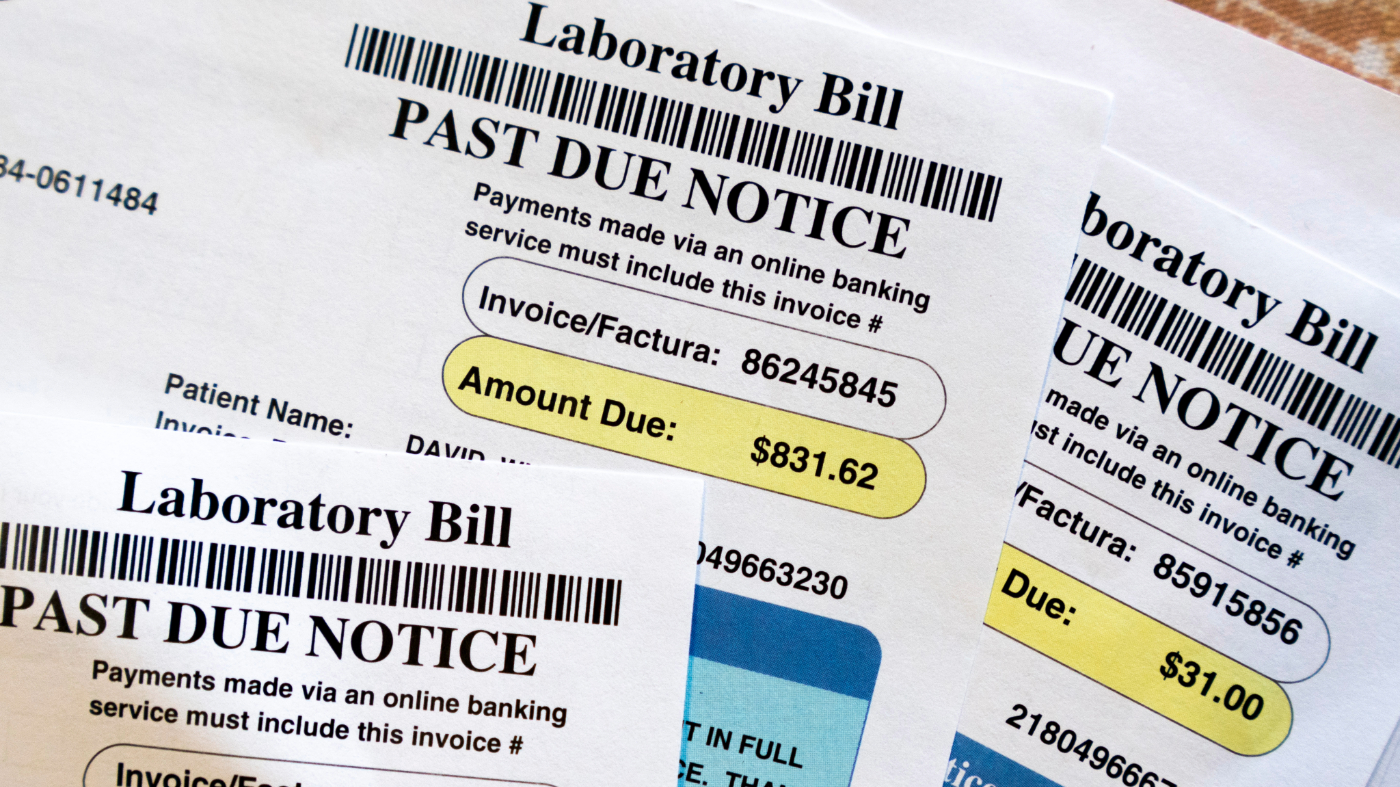

In a significant decision that could impact millions of Americans, a federal judge has overturned a key rule that was designed to remove medical debt from credit reports. This ruling means that unpaid medical bills could once again hurt the credit scores of nearly 15 million people.

U.S. District Judge Sean Jordan, in a decision issued on July 11, 2025, ruled that the Consumer Financial Protection Bureau (CFPB) – the agency that created the rule – did not have the authority to make such a change under current law.

What Was the Original Rule?

The overturned rule was finalized by the CFPB in January 2025, just before former President Joe Biden left office. Its main goal was to help Americans struggling with medical bills by:

- Removing an estimated $50 billion in medical debt from credit reports.

- Potentially boosting credit scores by an average of 20 points for about 15 million Americans.

- Making it easier for people to get loans, with predictions of around 22,000 additional mortgages being approved each year.

The idea behind the rule was that medical debt is often unexpected and doesn’t always reflect a person’s ability to pay other debts. Many medical bills also contain errors.

What Does the Judge’s Decision Mean for You?

The reversal of this rule has immediate and long-term consequences for those with outstanding medical bills:

- Credit Scores at Risk: For about 15 million Americans, unpaid medical debt could now reappear or remain on their credit reports. This can lower credit scores.

- Higher Borrowing Costs: A lower credit score can mean higher interest rates on important loans like mortgages, car loans, and credit cards.

- Limited Access to Loans: It might become harder to qualify for new loans if medical debt negatively affects your creditworthiness.

This decision comes at a time when many Americans are already facing financial challenges due to healthcare costs.

Why the Reversal? The Authority Debate

Judge Jordan, an appointee of President Donald Trump, stated that the Fair Credit Reporting Act (FCRA), the law governing credit reports, does not give the CFPB the power to remove medical debt in this manner. He argued that while the CFPB can “encourage” lenders to use other information, it cannot force credit agencies to exclude medical debt.

The credit reporting industry, including groups like the Consumer Data Industry Association, supported the judge’s ruling. They argue that medical debt, like other debts, is important for lenders to assess a person’s ability to repay loans and that the decision helps protect the “integrity” of the credit reporting system.

Political Back-and-Forth & Future Outlook

This ruling also highlights a political difference in how federal agencies should operate. It aligns with efforts by some, including the Trump administration, to limit the power of regulatory bodies like the CFPB. Former Vice President Kamala Harris, a strong advocate for medical debt relief, criticized the ruling, stating that no one should face financial hardship simply because they got sick.

While this federal rule is overturned, it’s important to note:

- State Protections: Some states, like New York, may have their own laws that prevent medical debt from appearing on credit reports, offering local protection to residents.

- Future Actions: Consumer advocates are now calling on Congress to take legislative action to create new federal laws that specifically address medical debt and its impact on credit scores.

This decision marks a significant development in the ongoing debate about medical debt and its role in personal finance, leaving many Americans to navigate the complexities of their credit health under renewed pressure from healthcare costs.